The BlueInvest Investor Report 2024 shows a remarkable increase in blue economy investments in recent years.

Findings show that an investment ecosystem to support blue economy innovation is taking shape, and the BlueInvest initiative has been a driving force behind this change.

5 key insights on the blue economy investments landscape in the EU

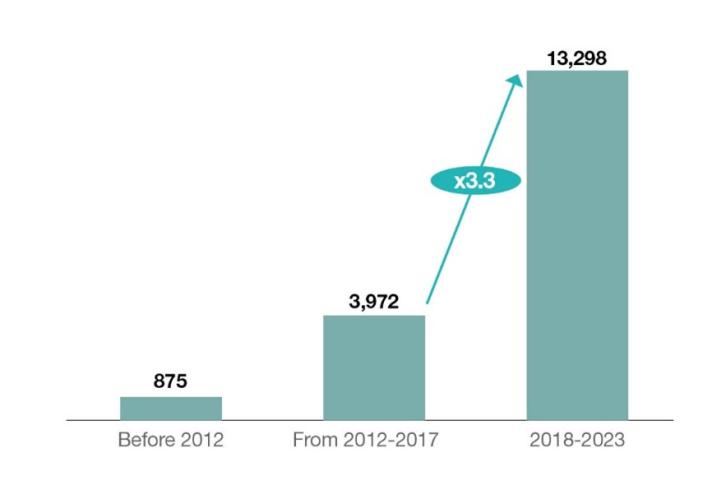

1. The volume of disclosed investments in the blue economy has significantly increased.

It is 3 times larger than it was 10 years ago, reaching more than €13 billion over the five-year period between 2018 to 2023.

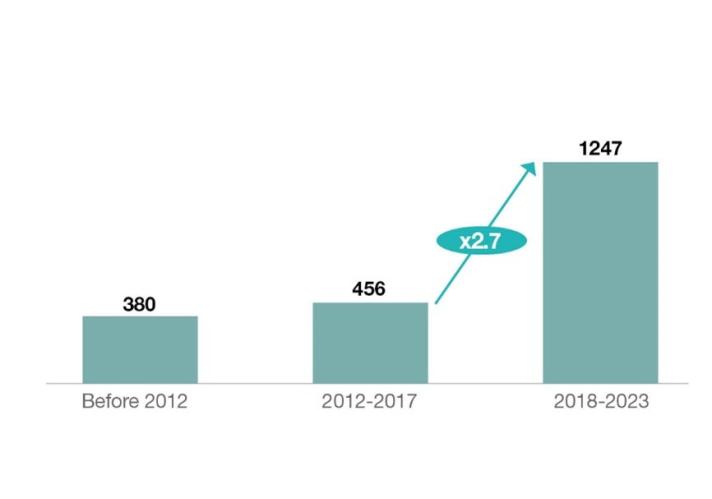

2. Since 2018, the number of deals in the blue economy has increased

- about 270 deals have been closed every year in the blue economy

- at least 30 private equity/venture capital funds are focused on blue economy deals, and the number is growing

This trend indicates a positive outlook and a strong growth pattern for the sector.

3. 75% of European blue economy deals occur within the EU, with half of the investors coming from non-EU countries.

This shows how EU companies create substantial business opportunities that attract investors from other regions.

4. In terms of the number of deals, mergers and acquisitions represent about 38%, followed by early-stage equity investments (34%), ahead of growth-equity investments (11%), and grants (7%).

This suggests a limited average level of maturity of the blue economy sector overall, particularly given the relatively modest amounts being invested into growth-stage companies.

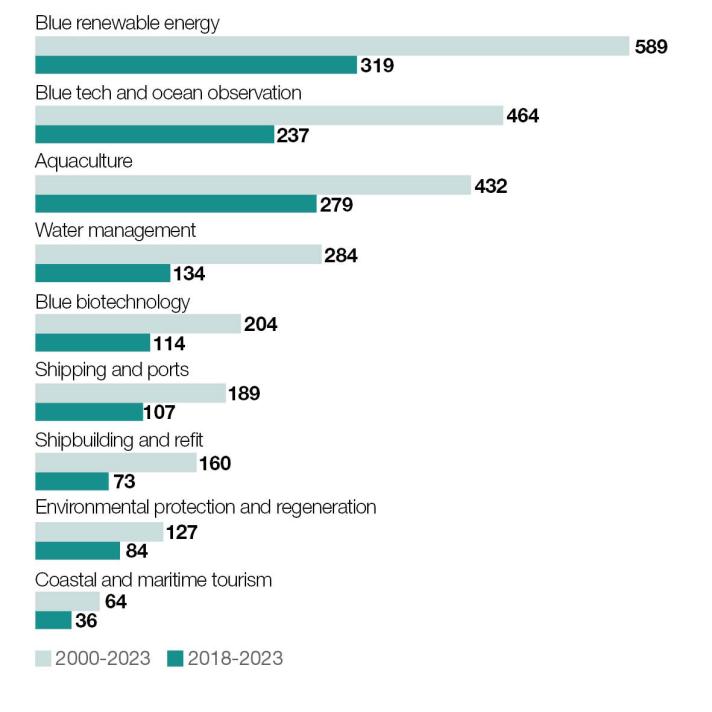

5. The 3 most dynamic sectors are blue renewable energy, blue tech and ocean observation, and aquaculture.

At the other end of the spectrum, sustainable coastal and maritime tourism as well as environmental protection and regeneration have closed fewer deals.

Background

The BlueInvest Investor Report 2024 is a useful tool for investors looking for opportunities in the sustainable blue economy.

The blue economy encompasses all economic activities based on or related to the ocean, seas and coasts. This includes fisheries, aquaculture, coastal tourism, shipping and ports, offshore renewable energy, and biotechnology.

BlueInvest is an EU initiative that aims to boost innovation and investment in sustainable technologies for the blue economy. It offers assistance to access financing for early-stage businesses, SMEs and scale-ups as well as capacity-building for investors. BlueInvest is enabled by the European Maritime and Fisheries Fund and is supported by the EIB group.

Details

- Publication date

- 3 April 2024

- Author

- Directorate-General for Maritime Affairs and Fisheries